Pocket Option Tax Form: Navigating Your Tax Obligations

Ganar dinero con la opción de bolsillo is an art and a science. As online trading gains popularity, navigating the financial and legal complexities becomes crucial. One essential aspect of trading is understanding tax obligations related to your trading activities.

Trading on platforms like Pocket Option might seem straightforward. However, ensuring compliance with tax regulations isn’t as simple. Traders must know what tax obligations they have, including how to file their taxes correctly based on their earnings from such platforms.

Understanding Pocket Option

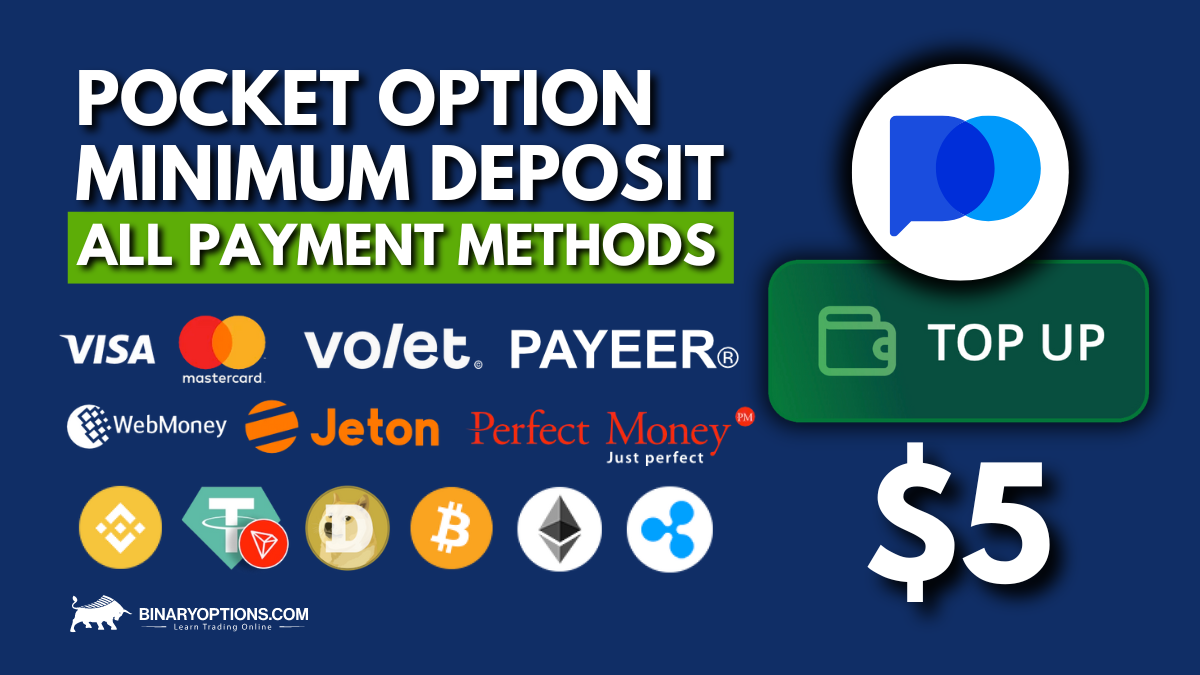

Pocket Option is a widely used platform for binary options trading, offering a simplified and accessible approach to trading. It attracts traders from various parts of the world due to its user-friendly interface, diverse trading tools, and potential for rapid earnings.

Like any income-generating activity, binary options trading is subject to taxes. Comprehending how taxation works in this context is crucial to avoid legal complications and optimize your tax situation. The focus here is on the Pocket Option Tax Form – a concept every trader should familiarize themselves with.

The Importance of the Pocket Option Tax Form

The Pocket Option Tax Form is not an official form provided by the platform but represents the necessary documentation traders should know about to report their earnings. Reporting trading income accurately prevents issues with tax authorities and ensures compliance with fiscal policies.

Types of Income and Their Tax Implications

Binary options trading can generate various types of income, and each has distinct tax implications:

- Capital Gains: Profits made from the buying and selling of financial instruments are typically classified as capital gains, subject to capital gains tax in many jurisdictions.

- Ordinary Income: In some cases, trading profits might be classified as ordinary income, affecting how they are taxed.

Steps to Accurately Report Pocket Option Earnings

Filing taxes for trading activities involves several critical steps. Here’s a comprehensive guide on how to accurately report your earnings from Pocket Option:

-

Documenting Trades

Maintaining an accurate and detailed record of all trading activities is paramount. This should include:

- Details of each trade (date, time, asset, buy/sell indicator, etc.)

- Profit or loss resultant from each trade

- Any fees or commissions paid

-

Determining Taxable Income

After documenting, the next step is to calculate your taxable income. This involves summing up all your gains and losses to determine the net profit or loss for the fiscal year.

-

Filling the Appropriate Tax Forms

The specific tax forms will depend on your country of residence and its tax laws. Typical forms might include:

- Tax return forms for individuals

- Forms for reporting capital gains

- Other specific forms for self-employed or freelance traders

Liaising with a tax professional can provide clarity on the exact forms needed.

-

Filing Deadline and Payments

Ensure you are aware of the filing deadlines and potential penalties for late filing. It’s crucial to submit your tax returns within the stipulated time to avoid issues with tax authorities.

International Tax Considerations

For traders who are trading internationally or reside in countries different from where Pocket Option operates, understanding international tax obligations is crucial. Different countries have different rules regarding international income and taxation. Key considerations include:

- Double Taxation Agreements (DTAs): These treaties between countries help determine which country has taxing rights over your income and can prevent the double taxation of the same income.

- Foreign Tax Credits: Some countries offer credits for taxes paid abroad to mitigate the financial burden imposed by double taxation.

- Compliance with Local Regulations: Besides international treaties, traders must comply with local tax regulations relevant to foreign income.

Common Mistakes to Avoid

Avoiding common mistakes can save you from hefty penalties and legal issues. Here are prevalent errors traders make regarding their tax forms and reporting:

- Neglecting to Keep Comprehensive Records: Incomplete or inaccurate records can lead to misreporting and scrutiny from tax authorities.

- Misclassifying the Nature of Income: Understanding whether your trading proceeds are capital gains or ordinary income is essential for accurate tax reporting.

- Ignoring International Reporting Obligations: If you have income from international trading activities, not adhering to reporting obligations can lead to severe penalties.

Working with Tax Professionals

Given the complexities and nuances involved, working with an experienced tax consultant or accountant familiar with trading income can provide substantial benefits:

- Ensuring Compliance: They can help ensure you meet all legal requirements while optimizing your tax liabilities.

- Expertise in Tax Planning: Professionals can aid in strategic tax planning, potentially reducing your overall tax burden.

- Assistance with Complications: If audit issues arise, having a tax professional on your side can facilitate smoother resolutions.

Conclusion

Understanding how to navigate your tax obligations related to binary options trading on platforms like Pocket Option is essential. While it can seem daunting, being proactive, keeping accurate records, understanding the type of income you earn, and working with professionals can mitigate potential issues. By managing these aspects effectively, you ensure greater focus on what matters most: enhancing your trading skills and strategies.

Leave a Reply